Investment Criteria

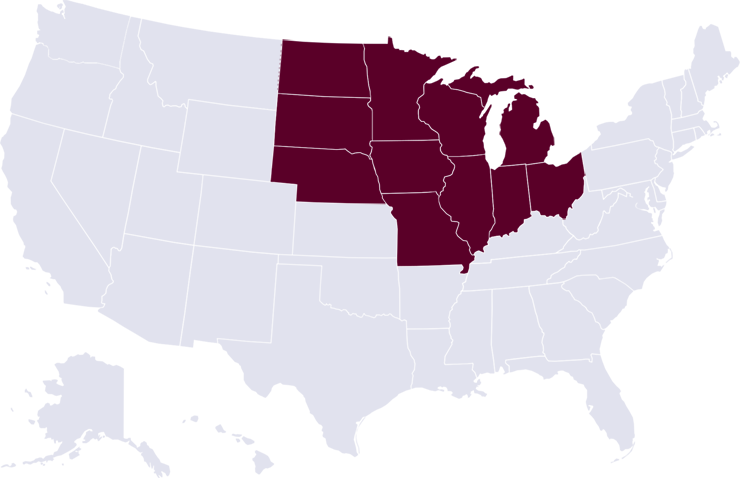

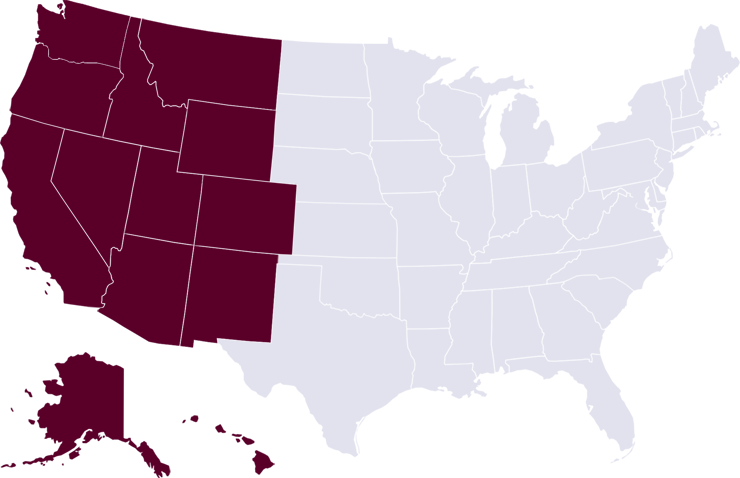

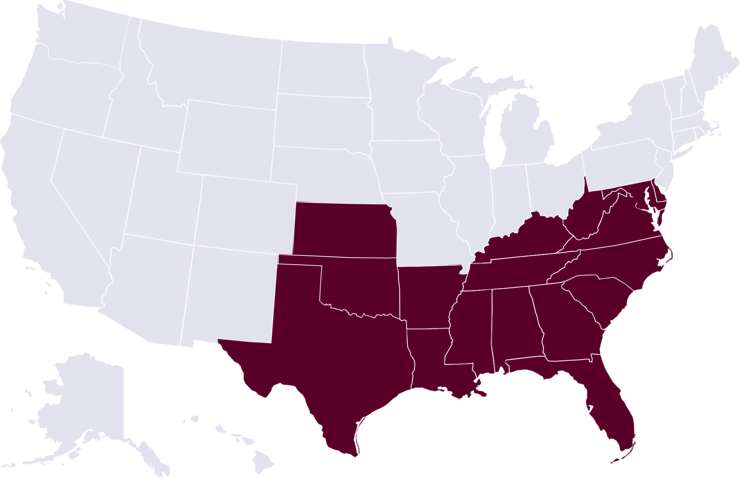

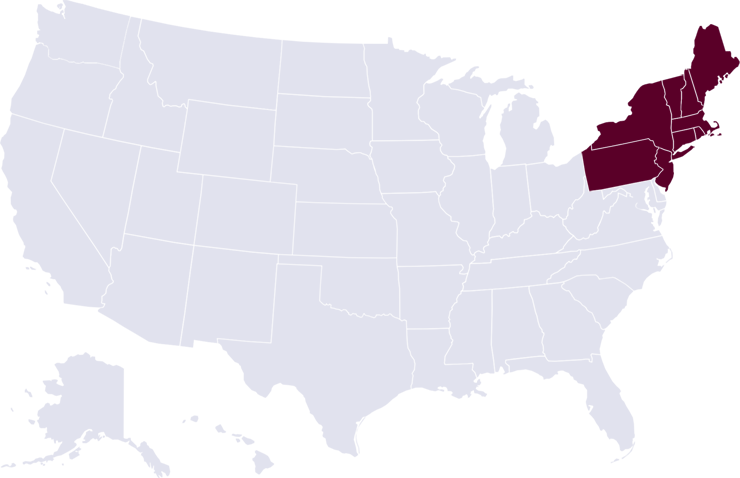

96 Investments Across the United States

Transaction Types

Management Buyouts, Recapitalizations, Acquisition Financings, Shareholder Liquidity Events, Growth Financings and ESOPS.

Investment Size

At least $15 million

Industries

Manufacturing and service businesses across a variety of industries

Company Size

Revenue of at least $20 million

EBITDA of at least $4 million

Characteristics

Experienced management team

Strong cash flow

Established industry

Growing market share

Structure

Meaningful equity ownership (control or non-control) combined with subordinated debt with current yield.

Involvement

Serve as board-level advisors rather than day-to-day managers or operators

Not Considered

Start-ups, turnarounds, real estate financings, restaurants, oil and gas exploration